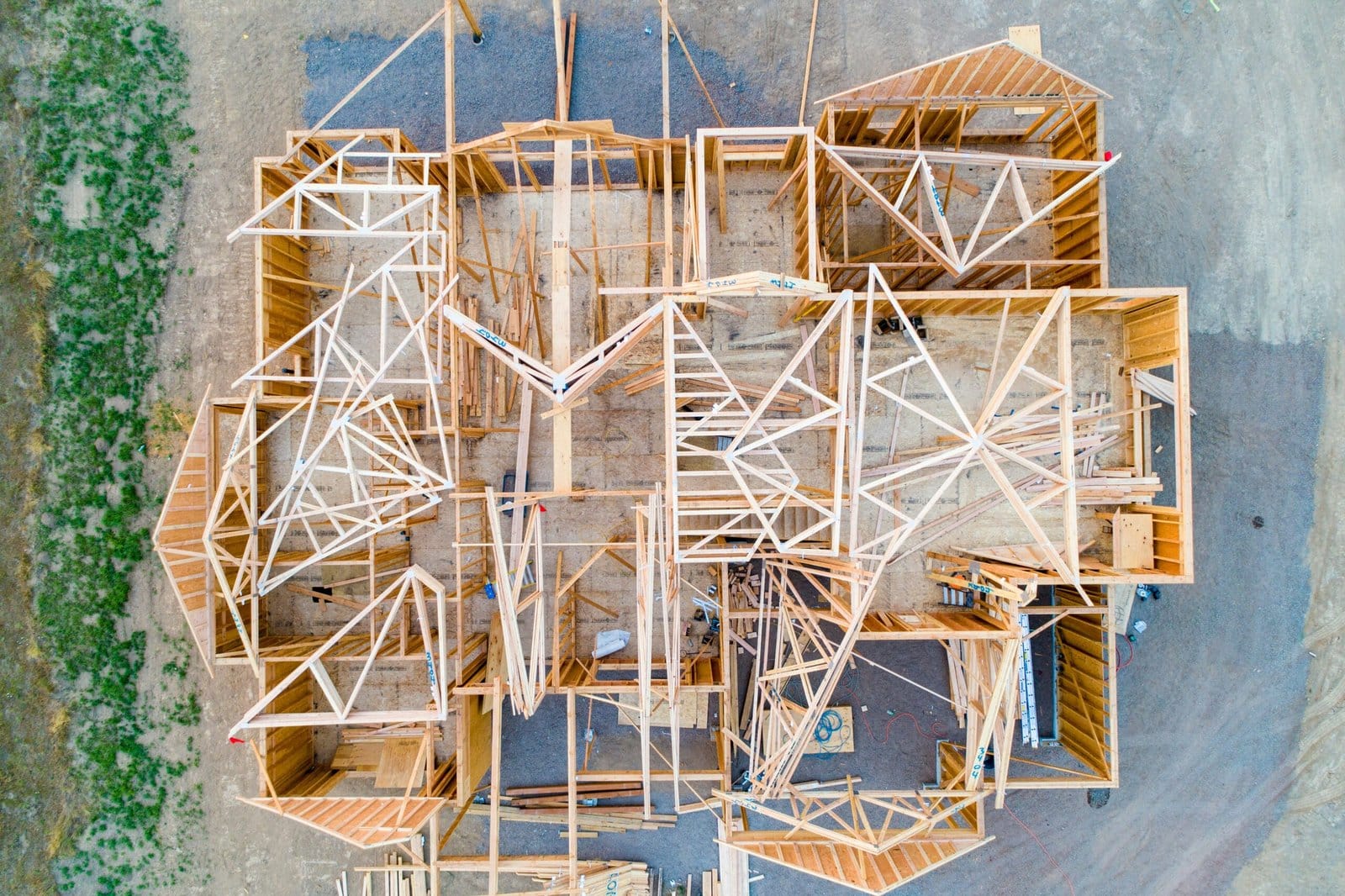

There is no doubt Covid-19 affected all aspects of our lives. The desire for a bigger home increased dramatically, with families needing room for homeschool space and 2 offices. It created an influx of buyers and not enough homes on the market, so new build construction skyrocketed to keep up with the demand of buyers looking for a way out of being 1 of 20 offers on a pre-built home. The number of new build starts went close to 1.9million in early 2022.

Comparing the beginning of each subsequent years, 2023 and 2024, the number of new build starts have gone down to as low as 1.3million, which is a 32% decrease. This number happens to also be the number of new build starts in the beginning of 2020 (right before Covid shutdown).

Have things just leveled out, or is there more behind the numbers? Looking at simple numbers, one could assume it’s because the Covid-rush to move out has settled and gone back to “normal.” But, we haven’t factored in the market as a whole yet.

Buyers are practically non-existent right now in pre-built home sales and that is carrying over to new build construction sites as well. Due to high interest rates, the lack of buyers not only are effecting sellers, it is also effecting construction companies. Without guaranteed home sales, construction is thus slowly down right along with pre-built sales.

Which begs the ultimate question, if interest rates came down, what kind of frenzy that would look like?

Data obtained and interpreted from:

Leave A Comment